Why is Personal Financial Management an Important Life Skill?

Personal financial management is an extremely important and necessary life skill in today’s world. Mastering the principles and effective methods of personal financial management ensures financial stability and achieves personal goals. Understanding how to manage personal cash flow will not only help you maintain your earnings but also generate additional income and promote personal development.

Efficient personal financial management allows you to control and plan your personal finances. You will know exactly how much you earn and spend on a daily basis. By tracking your expenses, you can identify unnecessary expenditures and, in turn, save more. Saving helps you accumulate reserves and prepare for the future.

Principles of Effective Personal Financial Management

Mastering the Amount of Money You Earn and Spend Daily

First and foremost, mastering the principles of personal financial management is crucial. You need to understand the amount of money you earn and spend on a daily basis. By tracking your expenses, you can identify unnecessary expenditures and save more.

Identifying Personal Financial Goals

Secondly, determine your personal financial goals. You need to know what you want to achieve in life and set specific goals to accomplish that. Having goals will help you focus and provide motivation to save and invest.

Build a Solid Foundation for the Future through Investment

Next, build a solid foundation for the future through investment. Investing is a good way to increase income and create a larger source of funds in the future. You can invest in stocks, real estate, or other financial instruments. However, remember that investing carries risks, so research thoroughly before deciding to invest in any type.

Always Have an Emergency Fund

Furthermore, always have an emergency fund. You cannot predict the difficulties that may arise in life, so always set aside a portion of your monthly income for an emergency fund. This fund will help you overcome sudden financial difficulties and keep your life stable.

Monthly Budget Planning

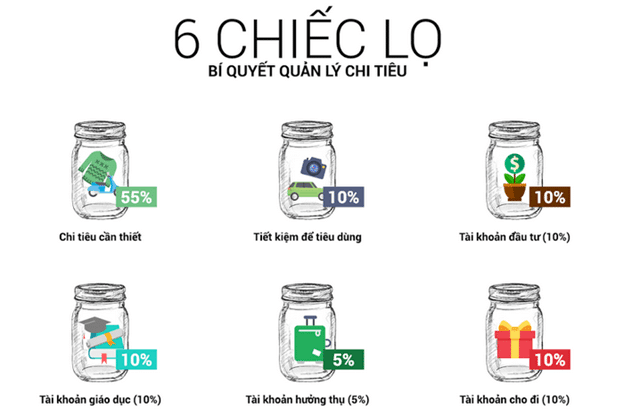

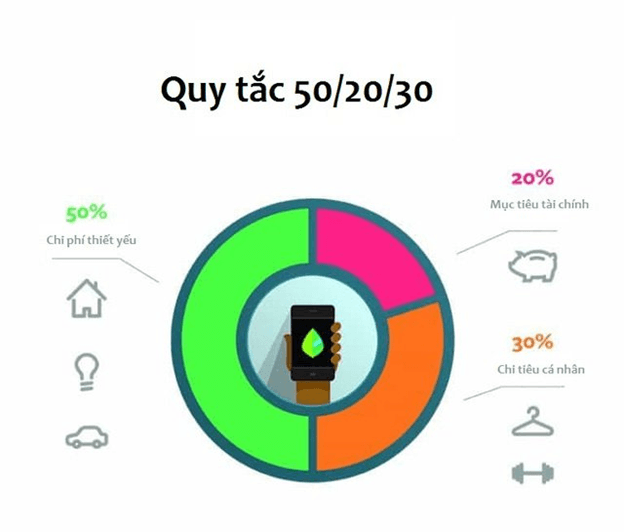

Lastly, consider monthly budget planning. By budgeting, you can determine the amount of money you have and decide how you will spend it during the month. Budget planning helps you control expenses and save money efficiently.

Personal Financial Management and Successful Strategies

There are many personal financial management strategies shared by successful entrepreneurs such as Warren Buffett, Oprah Winfrey, and Bill Gates. Here are some personal financial management strategies that you can apply to achieve financial freedom:

Invest in Knowledge and Self

One of the most important personal financial management strategies is to invest in knowledge and self. Read books, take courses, and learn about investment tools and methods. Do not hesitate to invest in improving your skills and knowledge to manage personal finances intelligently.

Know That Time is Precious

Time is a valuable asset that can significantly impact your financial situation. Start saving and investing from a young age. The magical power of compound interest will help you create a large source of income in the future.

Learn About the Financial Market

Understanding trends and fluctuations in the financial market will help you make informed investment decisions. Learn about financial instruments such as stocks, investment funds, and real estate. Join courses or seek reliable advice to gain more knowledge.

Learn to Deal with Risks

Personal financial management is not just about controlling and increasing income but also involves dealing with risks. Learn about insurance methods and how to protect your assets from hidden risks. Build social networks and focus on the financial community

Relationships and social networks can create many business and investment opportunities. Build a reliable social network and learn about the financial community to gain more knowledge and investment opportunities.

Conclusion

Personal financial management is not only an important life skill but also a way to ensure financial stability and achieve personal goals. You need to master the principles and methods of personal financial management, apply the strategies of successful individuals, and create a solid financial future for yourself.

Start with small steps to manage personal finances more effectively. Master daily spending, identify personal financial goals, invest in the future, create an emergency fund, and plan your monthly budget. Along with the strategies of successful entrepreneurs, you will become a smart and successful personal financial manager.