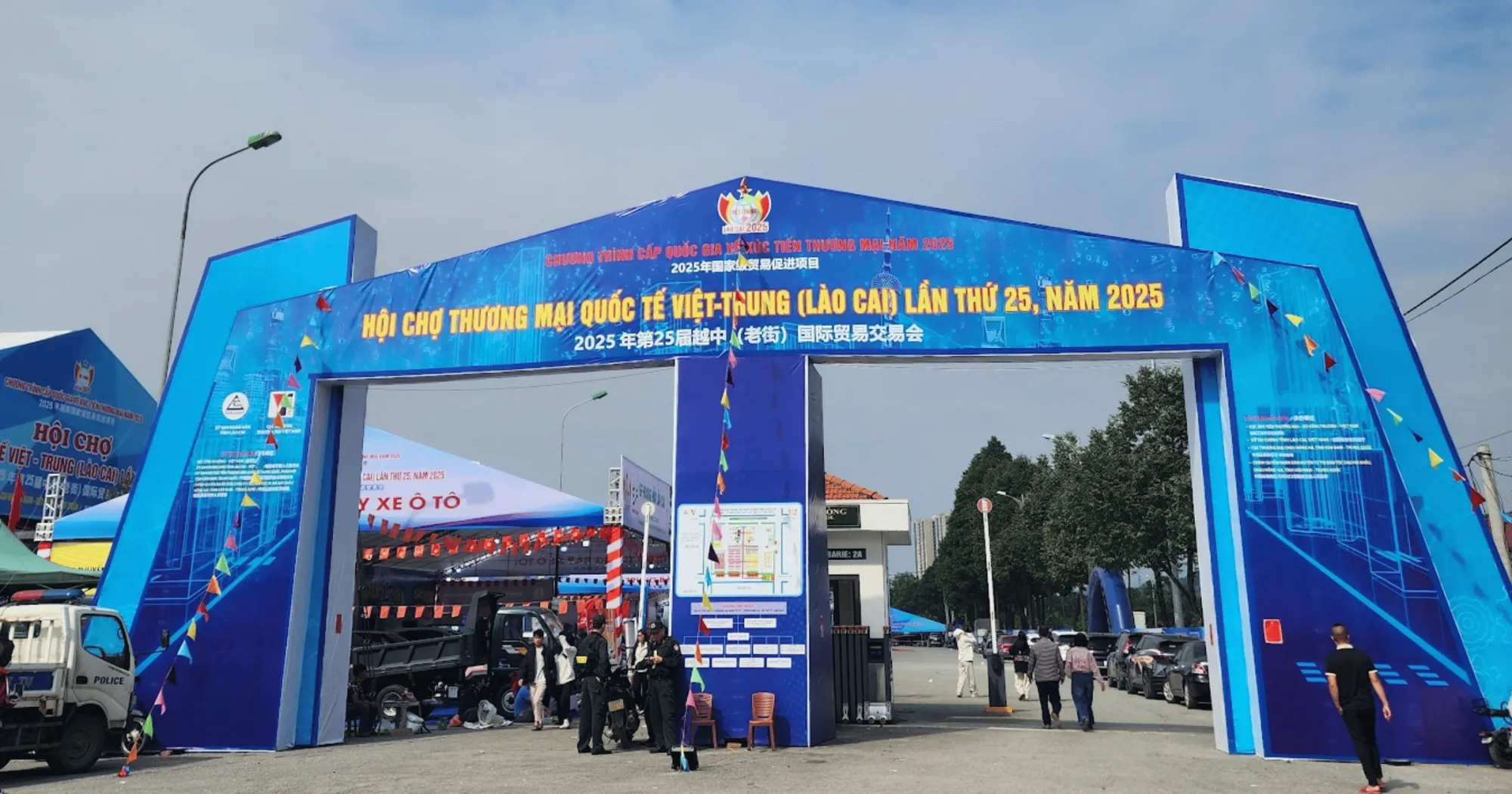

OEM in the past two decades, no longer a strange word, Vietnam has emerged as the world’s “expanding factory”. Many factory owners have invested systematically: ISO/IEC standards, IATF 16949 (automobiles), BRC/IFS (food), SA8000/WRAP (labor), ISO 14001 (environment)…; automated production lines, traceability, even meeting EU-US standards to process for high-end brands. But when returning to the domestic market, many businesses struggle: products have difficulty entering distribution channels, prices are difficult to compete, consumers do not know the brand. Why is it possible to “build a factory” but difficult to “build the Vietnamese market”? The article analyzes the core causes and suggests feasible directions.

1) “Factory-first” thinking wins over “market-first”

The starting point of success for many businesses is production capacity: doing the right thing – enough – on time according to foreign partners’ requirements. This unintentionally creates a bias: considering the factory as the center, and the market as just an output “if any”. Meanwhile, with consumer brands, the order must be reversed: touchpoints – positioning – experience – distribution lead production. Due to the lack of “market-first”, many businesses:

- Select product categories based on factory capacity, not based on Vietnamese people’s needs – usage context – willingness to pay.

- Confusion in value proposition: products are “export-like” but do not address differences in domestic context (climate, usage habits, after-sales service).

2) Brand Gap & User Story

Good OEM does not mean good brand storytelling. In the domestic market, consumers need:

- Easy-to-remember – easy-to-pronounce – easy-to-associate brand names;

- Clear brand promise (durable – safe – economical – luxurious…);

- Social proof (certifications, reviews, warranties, real-life cases).

- Many businesses only promote international standards (ISO, CE, FDA…) but lack the language of life. The result: the brand is technically “correct” but emotionally “strange”.

3) Domestic distribution chain: expensive, dense, difficult to control

Vietnam’s distribution channels are fragmented: traditional markets, agents, modern retail, e-commerce, project channels… Each channel has different service costs (discounts, displays, inventory, returns, promotions, sell-in/sell-out personnel).

Enterprises used to doing FOB (delivery at port) are often shocked by the “stick & carrot” of the domestic channel: having to invest in merchandising, displays, listing fees, stimulus programs, on-site warranties, and extremely fast response speeds. Unable to build a P&L by channel, unit economics collapses even when the factory is very efficient.

4) Retail price: “EU standard” but Vietnamese wallet

“EU standard” goods often entail a high cost structure: imported raw materials, testing, standard packaging, traceability, strict QC. When adding domestic channel costs, the retail price is easily beyond the acceptance of most consumers.

Meanwhile, purely domestic/cheap imported competitors play a different game: minimizing parameters, cutting “redundant” features in the Vietnamese context, focusing on SKUs that run and turn around quickly. “International standard” businesses, if they do not redesign the value package (not just reduce prices), will be stuck between being expensive but not different enough.

5) After-sales service & warranty network

The domestic market highly values after-sales service (warranty, installation, exchange, spare parts/consumables, hotline), especially for electricity-electronics, mechanics, construction materials, household appliances, etc. Many factories are used to delivering container shipments to foreign partners, so they lack an after-sales ecosystem. When Vietnamese customers have problems, slow response erodes their reputation; retailers are also reluctant to import more because of the long complaint handling time.

6) Organization & People: Lack of “Market Team”

In addition to a very strong technical and production team, many businesses lack a professional “market team”:

- Trade marketing/Channel understands channel structure;

- Brand knows how to position, plan categories, packaging, messages;

- Sales GT/MT/B2B/B2G understands local shopping process;

- E-commerce operates multiple platforms, D2C, customer care;

- Revenue management to optimize categories – prices – promotions.

- Without this structure, “putting goods out for sale” easily becomes a promotion burn.

7) Channel Conflicts & OEM Contract Barriers

Outsourcing contracts for foreign manufacturers sometimes have restrictive market/design/packaging clauses to avoid conflicts. Although not completely prohibited, the risk of “collision” with the partner’s customers can cause businesses to limit their domestic product lines, or be forced to change components, causing a cost/value imbalance.

8) Different standards – different needs

International standards aim for safety – uniformity – compatibility in the global supply chain. Domestic standards (end users) emphasize on-site convenience: flexible installation in cramped tube houses, anti-mold, anti-fine dust, anti-insect, withstand unstable voltage, easy to clean, easy to buy spare parts in the province… If the design is not localized from the brief, the product will be difficult to “use” even if it meets all the certificates.

9) Lack of user data & digital marketing capabilities

B2B exports require less understanding of the consumer journey. In contrast, domestic retail requires awareness – consideration – purchase – repurchase – advocacy data. Without CRM, CDP, and marketing measurement systems, businesses find it difficult to optimize customer acquisition costs and build a loyal customer base to increase lifetime value (CLV) to offset channel costs.

The “factory to market” roadmap (practical suggestions)

- Reverse the thinking axis: Take the segment & usage context as the center, then return to the technical – cost constraints.

- Close the portfolio by unit economics: Each SKU must have its own P&L by channel (GT/MT/ecom/B2B). Discontinue “vanity SKUs”.

- Design local value packages:

- Optimize “must-have” features for Vietnam;

- Standardize accessories/consumables that are easy to buy in the province;

- Customize packaging – instructions – warranty according to the usage context of Vietnamese households.

- Build a “market team”: minimum Brand + Trade + Channel Sales + Ecom + CS; set KPIs according to sell-out, not just sell-in.

- Channel architecture & pricing policy: clear discount tiers, promotion rules, dealer protection zones, display-sales bonus mechanism; channel conflict management using D2C but limited scope.

- After-sales & experience: set up regional warranty centers, complaint handling SLAs, minimum spare parts inventory; create experimental touchpoints (pop-ups/roadshows) for technical product teams.

- Evidence-based marketing: use international standards such as “proof”, but tell stories with real-life problems – solutions – benefits. Real-life cases, “professional” KOLs/KOCs, user guide content.

- Data investment: unified POS/ecom, simple CRM/loyalty; measure CAC, conversion, retention, prioritize repurchase campaigns to drive CLV.

- Separate OEM and domestic brands: legal – design – channel – separate packaging; avoid “collision” with commitments with foreign partners and reduce image risks.

When not to try to be a domestic brand?

- The market is too crowded, the differentiation value is unclear, and channel costs are over-the-top;

- The product is forced to keep its export configuration (high cost), but domestic users are not willing to pay;

- The enterprise does not have a market team and is not willing to burn 12–24 months of tuition.

- In those cases, it is good to choose ODM for a partner, or joint venture with a branding-distribution team that has a ready roadmap.

Conclusion

Many Vietnamese factory owners have conquered international standards – that is an invaluable asset. But to win at home, another capacity is needed: understanding Vietnamese users, channel architecture, after-sales service, brand storytelling and channel P&L management. In other words, building a factory is a technical victory; building a market is a commercial system victory. When these two capacities meet on a “localization” portfolio, businesses will no longer be “manufacturing for foreign brands” as their only fate, but can survive well with their own Vietnamese brands in their homeland.